Price growth in many key consumer categories has slowed considerably or ceased altogether — but that has done little to dent consumer worries as the costs of housing and other services have continued to climb.

Among the broadest categories tracked by the consumer price index, or CPI, two of the ones most acutely felt by consumers — food and energy prices — hit 2.2% and 2.1% on a 12-month basis in March, respectively.

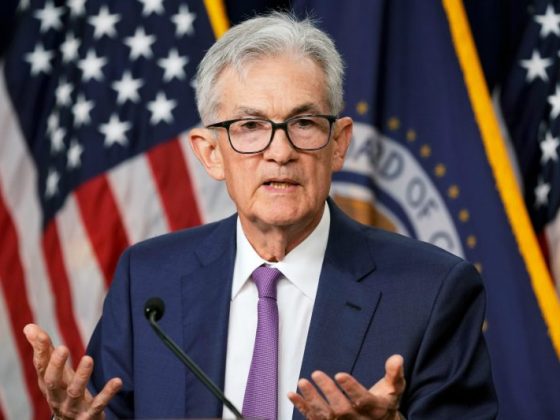

That’s essentially in line with the Federal Reserve’s 2% goal.

Within those categories, food at home — essentially, groceries — climbed just 1.2%, while gasoline prices climbed 1.3%.

‘Food is a notable bright spot,’ said Neil Dutta, head of economic research at Renaissance Macro Research.

In spite of the positive trends, progress in reducing overall CPI has stalled. Economists generally agree it’s mostly because the cost of rent has remained elevated, but there remains disagreement about how soon slowing rent growth will start to appear in the CPI.

Even as the Fed and other economists have preached patience, the upshot has been a CPI that has remained stuck between 3% and 4%, above the Fed’s 2% target, for more than a year.

On Wednesday, the Bureau of Labor Statistics will release CPI data for April, with 12-month expectations for a reading virtually unchanged from March’s 3.5%. Once again, rent growth is expected to keep the CPI elevated.