Former BitMEX CEO Arthur Hayes believes the emergence of spot Bitcoin (BTC) exchange-traded funds (ETFs) would be a game-changer for traders worldwide.

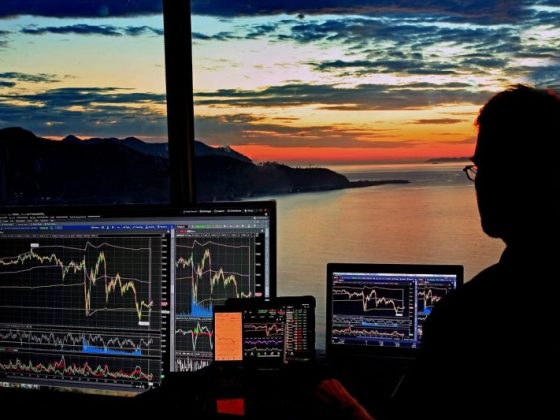

With Bitcoin prices displaying disparities between U.S. benchmarks and international markets due to global volatility, Hayes suggests that these ETFs could provide traders with a unique avenue for profit through arbitrage opportunities.

In a recent blog post, the crypto veteran emphasized the significance of Bitcoin as a global market, with price discovery primarily centered on platforms like Binance, which he noted is based in Abu Dhabi.

This presents a remarkable moment in time, where the Bitcoin market may experience a prolonged and predictable arbitrage opportunity.

“Hopefully, billions of dollars of flow will be concentrated in an hour-long period on exchanges that are less liquid and price followers of their larger Eastern competitors. I expect there to be juicy spot arbitrage opportunities available.”

The expectation is that spot ETF products will soon emerge in major Asian markets, particularly Hong Kong, which serves as a gateway for “China southbound flow.”

The presence of highly regulated exchanges and native crypto trading platforms in these markets could introduce further market inefficiencies, creating additional profit opportunities for astute traders.

Moreover, as Bitcoin trading becomes increasingly mainstream in the years ahead, the ETF-based financing sector is poised for significant growth.

Banks may establish desks offering fiat loans against Bitcoin ETF holdings, thereby capitalizing on the spread and influencing Bitcoin interest rates, which could further exacerbate market imbalances.

Arthur Hayes Expects Bitcoin to Correct by 30% in Short Term

Hayes, who had previously expressed a bearish outlook for Bitcoin in the short term, still maintains his view of a potential 30% price correction.

This sentiment is shared by several other traders, some of whom anticipate prices dropping as low as $38,000 before the next bullish leg.

As reported, Bitcoin posted its worst streak in about a month after the US Securities and Exchange Commission approved spot ETFs.

The leading cryptocurrency remained highly volatile in the past few days, ultimately trading little changed at $42,655.

The recent decline marked the longest losing streak for Bitcoin since mid-December, leaving investors puzzled about the cryptocurrency’s short-term direction.

The catalyst for this recent bout of turbulence was the introduction of nearly a dozen US ETFs focused on cryptocurrencies, which includes offerings from investment giants BlackRock Inc. and Fidelity Investments.

These ETFs officially started trading on January 11th, and Bitcoin initially surged to a two-year high above $49,000 in response.

However, the enthusiasm quickly faded, and the cryptocurrency retraced its steps.

Market analysts have attributed the Bitcoin price action to a classic “buy-the-rumor, sell-the-fact reaction.”

Tony Sycamore, a market analyst at IG Australia Pty, noted that chart patterns suggest a possible slide to the $38,000 to $40,000 range for Bitcoin.

This pattern suggests that the excitement over the ETFs had been largely priced into the market, leading to profit-taking by some investors.

Supporters of Bitcoin argue that these US spot ETFs represent a significant milestone for the cryptocurrency. This also provides increased access for institutional and retail investors.

On the other hand, skeptics point to the tumultuous year that cryptocurrencies, particularly Bitcoin, experienced in 2022, which was marked by a deep crash and subsequent bankruptcies.

Despite a partial market rebound last year, concerns about wider adoption linger.

The post Spot Bitcoin ETFs Present New Trading Opportunities Amid Global Price Swings: Arthur Hayes appeared first on Cryptonews.